The U.S. Supreme Court has decided to take on a case that could significantly impact religious organizations, focusing on a tax exemption request from the Catholic Charities Bureau in Wisconsin.

This comes through a recent order that allows the case, Catholic Charities Bureau, Inc. v. Wisconsin Labor Review Commission et al, to be heard at the highest court in the country.

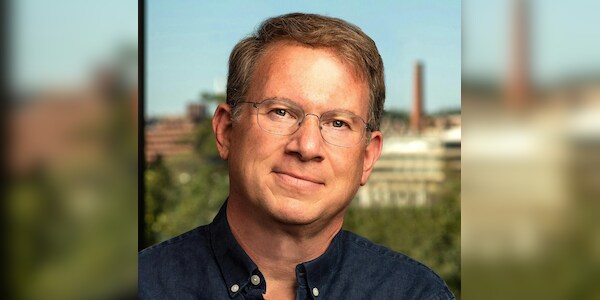

Eric Rassbach, who serves as vice president and senior counsel at Becket, the law firm backing Catholic Charities, expressed optimism about the proceedings, stating he believes the Supreme Court will side with them.

Rassbach didn’t hold back, saying, “Wisconsin is trying to make sure no good deed goes unpunished.”

He criticized the state for penalizing the charity, which provides services to both Catholics and non-Catholics, highlighting the absurdity of the situation.

Back in 2016, Catholic Charities sought an exemption from paying into Wisconsin’s unemployment insurance program, claiming their charitable activities were driven by their religious beliefs.

However, the Wisconsin Department of Workforce Development denied this request, stating the organization didn’t operate primarily in a religious capacity.

A different administrative law judge initially reversed this decision, but that was overruled by the Wisconsin Labor and Industry Review Commission, which found the charity’s actions mainly secular.

In a contentious ruling this past March, Wisconsin’s Supreme Court concluded with a 4-3 decision that Catholic Charities did not meet the criteria as a religious entity, eliminating its chances for the tax exemption.

Justice Ann Walsh Bradley encapsulated the court’s decision by stating that the charity was “not operated primarily for religious purposes,” which meant they were required to contribute to the unemployment program.

She pointed out that Catholic Charities and its sub-entities don’t make efforts to instill Catholic beliefs in those they serve, further framing them as a secular organization.

In August, Catholic Charities escalated the matter by filing a petition with the Supreme Court, emphasizing that even though they are controlled by a church, they were deemed ineligible for the religious exemption due to the nature of their operations.

This situation has serious implications for religious organizations, as the petition argued that paying into the state’s unemployment system takes away funds that could otherwise be allocated to help those in need.

Leave a Reply